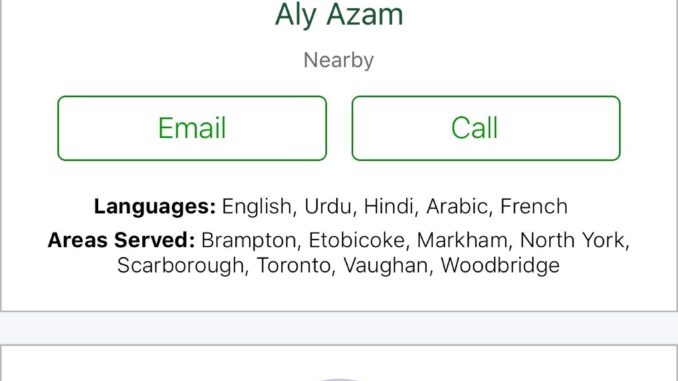

TORONTO, June 27, 2018 /CNW/ – TD Bank Group (TD) today announced the launch of a mortgage concierge service as the newest feature within its leading mobile banking app. Using geolocation technology, the new service connects customers with mobile mortgage specialists who are nearby and available, offering seamless access to mortgage advice for TD mobile customers. The concierge service is powered in part by technology developed by Canadian fintech Flybits and leverages the company’s secure, cloud-based mobile intelligence platform that matches location-based data from a customer’s mobile device with real-time information that now includes the location and contact details for TD mobile mortgage specialists.

“Our mortgage concierge service is a great example of how we are focused on developing connected and personalized experiences for our customers that add value and help them achieve their personal financial goals,” says Rizwan Khalfan, Executive Vice President and Chief Digital and Payments Officer, TD. “Home ownership is a goal for many of our customers and we saw an opportunity to look at how we can improve on the overall process and experience. This latest enhancement to our app helps us ensure we’re offering relevant, meaningful experiences for our customers and is a great first step towards transforming how we meet their needs in the future.”

The future of home-buying

A new survey by TD reveals that more than half (56 per cent) of Canadian first-time homebuyers are anxious and afraid that they’ll forget to take a crucial step as they gain their foothold on the property ladder. It’s no wonder that nearly one quarter of those polled (24 per cent) say that the home-buying process is stressing them out, while one fifth (21 per cent) admit they are simply overwhelmed.

“Our goal is to help our customers be better informed about the home ownership process and to support them along the way. We envision creating more services that will help us connect with our customers where and when it’s most convenient for them,” says Marc Kulak, Vice President, Real Estate Secured Lending, TD. “Part of our vision includes offering new, digitally-enabled platforms so customers can ask questions and receive real-time, in-the-moment updates about everything that relates to buying a home, from the status of their mortgage application, to answers to questions like: What type of mortgage should I get? How much do I need to save for a down payment?”

This new addition to the TD app adds to our in-person and self-serve mortgage tools available to help customers in their home-buying journey. TD recently launched a digital mortgage pre-approval application that helps customers shop for a mortgage with confidence by giving them a 120-day rate hold within minutes if they are approved after applying online. To help our customers plan for their purchase, our Mortgage Affordability Calculator uses financial information provided by the potential buyer to help them understand how much home they may be able to afford after monthly expenses, debt payments and savings are accounted for. It also links to active real estate listings that match a customer’s budget and desired neighbourhood.

The TD mobile app has consistently held the number one position in the finance category of the Google and Apple App Stores (Canada) and recently ranked #1 among Canadian retail banking apps according to app analytics and market data firm, App Annie.

About the TD survey

TD commissioned Environics Research Group to conduct an online survey among a total of 1,001 adults from February 5-14, 2018. All respondents had to be 18 –69 years of age, be a first-time homebuyer and reside in Canada.

About TD Bank Group

The Toronto-Dominion Bank and its subsidiaries are collectively known as TD Bank Group (“TD” or the “Bank”). TD is the sixth largest bank in North America by branches and serves more than 25 million customers in three key businesses operating in a number of locations in financial centres around the globe: Canadian Retail, including TD Canada Trust, TD Auto Finance Canada, TD Wealth (Canada), TD Direct Investing, and TD Insurance; U.S. Retail, including TD Bank, America’s Most Convenient Bank®, TD Auto Finance U.S., TD Wealth (U.S.), and an investment in TD Ameritrade; and Wholesale Banking, including TD Securities. TD also ranks among the world’s leading online financial services firms, with approximately 12 million active online and mobile customers. TD had $1.3 trillion in assets on April 30, 2018. The Toronto-Dominion Bank trades under the symbol “TD” on the Toronto and New York Stock Exchanges.

SOURCE TD Bank Group

Leave a Reply