Christie’s International Real Estate’s Canadian affiliate Chestnut Park says Toronto has

lowest time-on-market globally

Two Canadian cities – Toronto, followed by Victoria BC – top the list of “hottest” luxury residential real estate markets in the world, according to a new White Paper report released today by Christie’s International Real Estate and Canadian affiliate Chestnut Park Real Estate of Toronto, a Peerage Realty partner company.

The annual report examines how macroeconomic factors impact luxury home prices, inventory and sales globally across more than 100 real estate markets in the Christie’s affiliates universe. The definition of “luxury real estate” varies by market, but for Toronto (in 2016) it’s defined as properties worth $3 million (U.S.) and above. The average worldwide starting point for luxury real estate is $2.1 million (U.S.).

Overall, the international luxury real estate market softened in 2016, according to Christie’s, but markets such as Toronto and Victoria defied the trend, in part fueled by foreign, and in particular Chinese, buyers, the report says. Global uncertainty was named as a primary cause for some traditionally strong luxury markets to decline or stall.

Regionally, the growth in luxury real estate sales declined in the United Kingdom (down 67%), Asia Pacific (down 29%) and the United States (down 4%) while Europe rose 20% and Canada increased a whopping 44%.

Here are highlights:

- The already hot prime Toronto property market showed almost double the number of million-dollar-plus sales in 2016 vs 2015 and topped the global “Luxury Thermometer” list

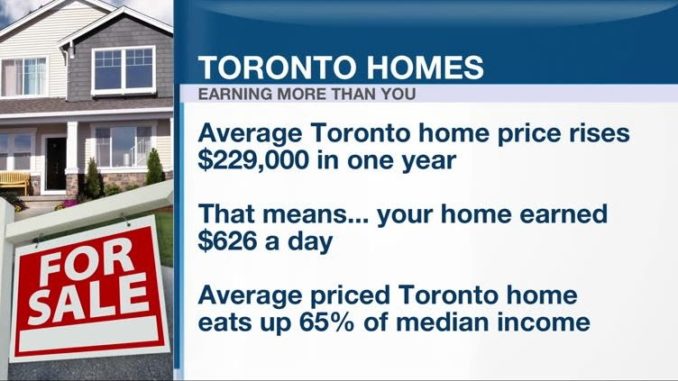

- Globally, luxury homes spent 221 days on market, up from 195 days in 2015 but the Toronto market stood at 17 days on market (down from 28 days in 2015) and the lowest in the world, fueled by extremely low inventory and rapid price increases that pushed buyers to act fast

- The Victoria BC market saw significant growth from affluent international buyers who were deterred by Vancouver’s new 15% foreign buyers tax

- The report says capital inflows from foreign buyers remained strong but shifted demographically. Notably, Chinese buyers penetrated markets in Montreal, new enclaves in Toronto and areas outside of Canada new to this buyer group, such as North Carolina

- Luxury second-home or vacation home sales rose 36% in Canada in 2016 vs a decline of 3% in the U.S., reflecting a prevailing sense of uncertainty among buyers, particularly foreign buyers. The heat of the Toronto urban luxury residential market spread to its feeder vacation home market of Muskoka, where values rose 20%. “The increase in sales volume is having a dramatic impact on supply, consistent with the urban market experience. The recreational marketplace is beginning to mirror Toronto,” said Chris Kapches, CEO of Chestnut Park Real Estate. Measured by unit, sales of million-plus homes were up 55% in Muskoka and 90% in Toronto

- The report sees softening in global luxury home sales overall with higher days on market and selling prices below asking — the result of hot property markets causing overly ambitious “windfall” pricing by sellers and eventual resistance by buyers

HOTTEST LUXURY MARKETS WORLDWIDE

(Based on year-over-year growth in sales of luxury properties, 2016 vs 2015)

- Toronto ON

- Victoria BC

- San Francisco CA

- Austin TX

- Charleston SC

Leave a Reply