The City of Toronto is encouraging all Toronto residents and businesses to urge the Government of Canada to honour its funding commitment to the people of Toronto. The City needs the federal government to provide promised COVID-19 pandemic support of $235 million for the City’s 2022 Budget, to match the Province’s commitment.

During the 2021 federal election, Prime Minister Justin Trudeau personally committed to help Toronto through the pandemic. To date, the Government of Canada has not provided this promised funding. Without federal support, City funding for future frontline services will be affected.

Approved by Council during consideration of Item EX1.7 Operating Variance Report for the Nine Months Ended September 30, 2022 (https://secure.toronto.ca/cou

• A campaign webpage: www.toronto.ca/shortfall

• An easy-to-use automated email for Toronto residents to contact their Member of Parliament to urge them to honor the Government of Canada’s commitment to the people of Toronto (https://www.toronto.ca/city-g

• A message on all residential and non-residential final property tax bills (regular, pre-authorized, mortgage, print and eBilling); 873,308 accounts in total

• The same message included in the 2023 Final Property Tax Bill Information brochure that will be mailed with final property tax bills to 846,494 accounts starting today

The message included on residential property tax bills and the 2023 Final Property Tax Bill Information brochure reads:

“Federal Funding Shortfalls – Toronto needs the Federal government to provide promised support of $235 million for the City’s COVID-19 impacts for 2022, to match the Province’s commitment. As of March 31, 2023, the Government of Canada has not provided funding that was promised largely for pandemic transit and homelessness costs. Without federal support, City funding for future frontline services will be affected. Please contact your Federal Member of Parliament to urge the Government of Canada to help the people of Toronto. More information can be found at toronto.ca/shortfall.”

The financial repercussions of the COVID-19 pandemic continue to have an enormous impact on the City’s budget – lost revenue from reduced TTC ridership, increased costs to shelter the growing number of people experiencing homelessness and much more.

The financial impacts of the COVID-19 pandemic continue to affect City finances in 2023 and beyond. As a result, sustained partnerships with both the Government of Canada and the Province of Ontario – orders of government whose revenues grow with the economy – is necessary.

More information is available on the City’s website: www.toronto.ca/shortfall.

Quotes:

“We are standing up for Toronto – Canada’s economic engine – and asking residents to join us in this fight. The City of Toronto does not have the resources or revenue tools to address the unprecedented financial pressures of the COVID-19 pandemic. We need the Government of Canada to keep Prime Minister Trudeau’s election campaign promise. Beyond the immediate support of $235 million required for the 2022 Budget shortfall, a new fiscal framework for Toronto is absolutely required, one that recognizes our city’s complexity, diversity and significant contribution to the success of the region, province and country.”

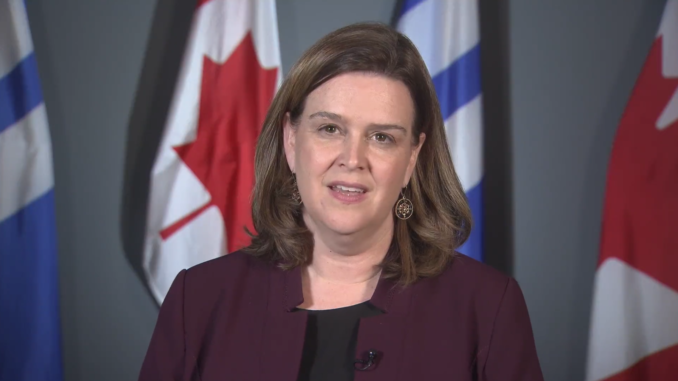

– Deputy Mayor Jennifer McKelvie (Scarborough-Rouge Park), Chair of the Infrastructure and Environment Committee

“Since the onset of the COVID-19 pandemic, we have identified more than $2.5 billion in City-led savings, offsets and mitigation efforts. This year, we introduced the largest residential property tax increase since amalgamation, and we have increased other taxes and fees such as the Municipal Accommodation Tax and TTC fares. The City and its residents have done what we can. It’s time for the Government of Canada to keep its promise and provide the necessary funding for our pandemic-fuelled 2022 Budget shortfall and beyond.”

– Councillor Gary Crawford (Scarborough Southwest), Chair of the Budget Committee

SOURCE City of Toronto

Leave a Reply